Finance Minister, Nirmala Sitharaman stated that this Union Budget 2021 will be different from the earlier budgets. Due to which curiosity among people was very high for this budget.

Along with that, It was stated that bills related to cryptocurrency will also be included in the budget, but yet there is no mention in the budget.

Income Tax

No change has been made in income tax, income tax. Neither any tax has been added nor any tax benefit has been given to Indians. Thus, senior citizens above 75 years will get some benefit. People who are over 75 years of age, who receive their income through pension and interest income, can no longer file for income tax.

Read More:- WhatsApp New Updates Privacy Policy: What it is?

The good thing is when filing for income tax is that much information such as salary, TDS, etc. is required, which will be the predecessor from now on. Capital gains on your investment, your dividend income, etc. will be prefilled by the Income Tax Department.

So how would it happen? The government will link your PAN card to different things, through which they will get your income and other information and will prefill all this information on your behalf. Due to these changes, a lot of information will be with the government, through which the government’s tax collection will increase.

Housing Loan

Those who took home loans through affordable housing received 1.5 lakh tax deductions. The deadline for this was 31 March 2020, which has now increased to 31 March 2022. In other words, its limit has been extended. Many people will benefit from this, who took loans through affordable housing.

Table of Contents

Budget 2021: What gets costlier, What’s cheaper now

What’s gets Cheaper

Gold & Silver

For Indians, the exciting news is that the customs duty on gold and silver has been reduced. In India, people like to buy and wear gold and silver, and thus it will benefit those who love jewelry.

But let me tell you that the Trade Deficit in India is due to one main reason which is gold. Because after oil, India imports excessive gold, which disrupts India’s trade balance and thus increases the trade deficit.

“CAD to rising gold imports among other causes. The CAD has widened to a record 6.7% of GDP during October to December”

A few years ago, the customs duty of gold and silver was increased to 12.5%, which has now been reduced to 7.5%.

“The finance minister Nirmala Sitharaman reduced customs duty on gold and silver from 12.5% to 7.5%. “

Now as people got excited to learn about the lower customs duty, the government added a new cess to it, which is 2.5% of agricultural infrastructure and development cess, which reduced the overall profit.

This cess is 2.5%, but in alcoholic beverages, this cess has increased to 100%. If we talk about electronics, the government has reduced the customs duty on iron, steel, and copper from 5% to 2.5%. Read for more details –Will the new Agriculture Infrastructure & Development Cess affect the common man?

Nirmala Sitharaman also mentioned that in India, the manufacturing industry is growing rapidly, and many chargers and mobiles are also being exported by India. Besides, the government has removed some exemptions from it.

What’s gets Expensive-

Customs duty on auto parts increased to 15%, customs duty on cotton was earlier 0% which has now increased to 10%, raw silk and silk yarn has also increased to 15%. This may increase the prices of silk products and cotton.

Petrol and Diesel

Petrol prices were already high. Due to COVID-19, the government increased the excise duty on petrol. These prices are also going up now because the government is adding Rs. 2.5 / liter on agriculture, infrastructure and development cess and diesel they are adding up. Rs.4/liter Agriculture, Infrastructure, and Development Cess.

Budget 2021: which sectors will get the benefit-

Automobile Sector

The government has made very good and big announcements for this sector. The big announcement is that the government is bringing the vehicle scrappage policy, with this policy the government will help people with older vehicles to replace them.

For people who have vehicles more than 15 years old, the government will help replace them. They will provide them with financial aid or tax benefits, and the program will be announced shortly.

This will greatly benefit the automobile industry as the demand in this sector will increase and due to this the shares of many automobile companies and tires have increased today.

MRF Share Price Picking- After Announcement of Budget 2021

Solar Energy Corporation of India

The government also wants to give a boost to the Non-Conventional energy sector, due to which the government will be investing Rs. 1,000 cr. to Solar Energy Corporation of India Limited and Rs. 1,500 cr. the investment will be done for Renewal energy development.

Due to this many renewal energies will be benefitted like Tata Power. Tata Power has a plan to focus more on renewal energies and gain the top hotspot in this sector.

For public buses, the government will invest Rs. 18,000 cr., due to which companies like Tata Motors and Ashok Leyland will benefit a lot.

Textile Industries, the government is bringing 7 textile parks in the coming 3 years, and thus this will benefit this industry.

Healthcare Sector

Due to COVID healthcare sector has been in demand. For this sector, the government has kept Rs. 2.23 lakh crores budget, which is quite a lot, and for vaccines they have kept a budget of Rs. 35,000 crores. Apart from this, in the coming 6 years, in the primary, secondary, and tertiary healthcare government will invest Rs. 64,180 crores

Apart from the healthcare, the insurance sector was also trending, because an announcement related to FDI is also made. Earlier, the FDI limit in insurance companies was 49% which has now increased to 74%.

Railway Sector

in FY2020 government will be investing Rs. 1.1 lakh cr. which will benefit the Indian Railway Finance Corporation. Because funding provided to the Indian government comes through IRFC.

Gas Sector

The government will be connecting 100 cities to cities’ gas distribution networks. Good news for small businesses is also made. The definition of small businesses has been changed.

Earlier businesses with Rs. 2crore turnover was considered small businesses, but now companies with 20 crore turnover will also be considered as small businesses. The limit for tax audit has increased to Rs. 10 crores from 5 crores. Many small businesses have benefited from this.

Government Capital Expenditure

“Capital expenditure is the part of the government spending that goes into the creation of assets like schools, colleges, hospitals, roads, bridges, dams, railway lines, airports, and seaports.”

Government capital expenditure, for FY2022, the government has set a target of 5.54 lakh crore, and this target was 4.39 lakh crore last year.

Union Budget 2020-21: Highlights

- Citizens above 75 years of age exempted from ITR

- Fiscal deficit for FY22 pegged at 6.8%

- The central university proposed to be set up in Ladakh

- Capital expenditure of rs. 5.5 lakh crore proposed for 2021-22 fiscal year

- Rs 15,700 crore provided for the MSME sector

- A new Development finance institution (DFI) proposed to be created

- Aim to complete 11,000 km of national highway infrastructure this year

- Rs 35,000 crore for covid-19 vaccine

- PM Aatmanirbhar swatch Bharat to be launched with an outlay of 64,180 crores over 6 years

Source – https://www.indiabudget.gov.in/ - Rs 18,1000 Scheme to increase public transport in urban areas

- Rs 1,500 crore for promoting a digital mode of payment

- Jal Jeevan mission gets an outlay of Rs 2.87 lakh crore

- The Urban Swachh Bharat Scheme will be implemented with an outlay of over Rs 1.4 lakh crore

- Rs 1.10 lakh crore outlay for Railways, of which Rs. 1.7 lakh crore if for capital expenditure

- Rs 2,217 crore for 42 urban center to tackle problems of Air Pollution

- Rs. 3.05 lakh crore outlay for power sector

- Infusion of Rs. 20,000 crore for public sector bank

- Definition of small companies to be revised by raising the capital base to Rs 2 cr from the current limit of Rs. 50 lakh.

Effect of Budget 2021 on Price

Price Increased

- Petrol and Diesel

- Mobile Phones

- Power Banks

- Imported Alcohol

- Refrigerators

- Air conditioners

- Imported Toys

- Cloths

Price Decreasing

- Gold and silver

- Naphtha

- Copper scrap

- Metal coins

- Nylon fiber

- Platinum

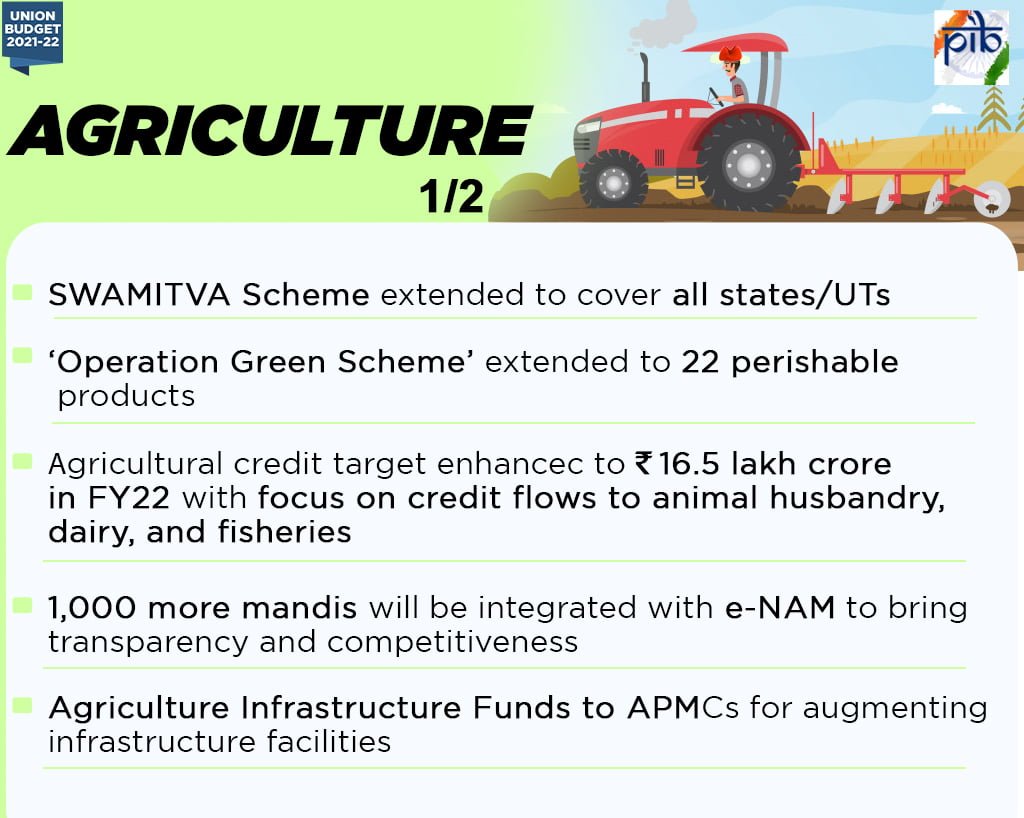

Agriculture Scheme

Read more:- Apple iPhone 13: Apple is Removing the Charging Port?